Individual Tax Rates 2025 South Africa

BlogIndividual Tax Rates 2025 South Africa - Calculate your personal income tax for 2025/2025. And this window runs till 21 october 2025. Individual Tax Brackets 2025 South Africa Yetty Mersey, The rates for the tax year commencing on 1 march 2025 and ending on 28 february 2025 are as follows: Granting income tax relief by adjusting brackets and rebates for the effect of inflation.

Calculate your personal income tax for 2025/2025. And this window runs till 21 october 2025.

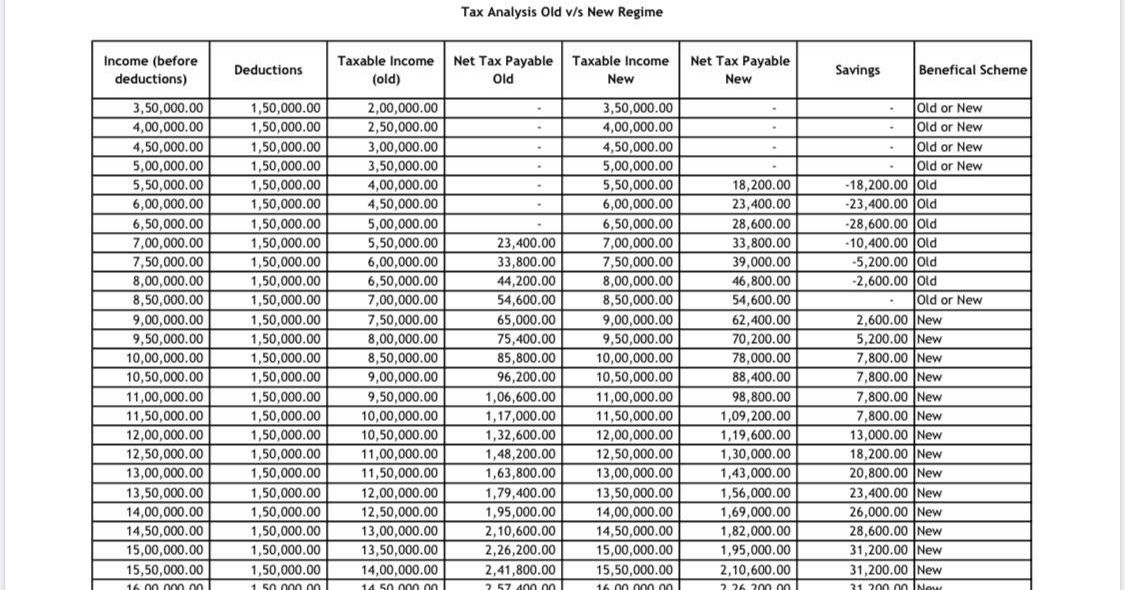

The tax rates for the 2025 tax year, starting on 1st march 2025 and ending on 28th february 2025 are:

Tax Rates 2025 2025 Image to u, 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa. The rates for the tax year.

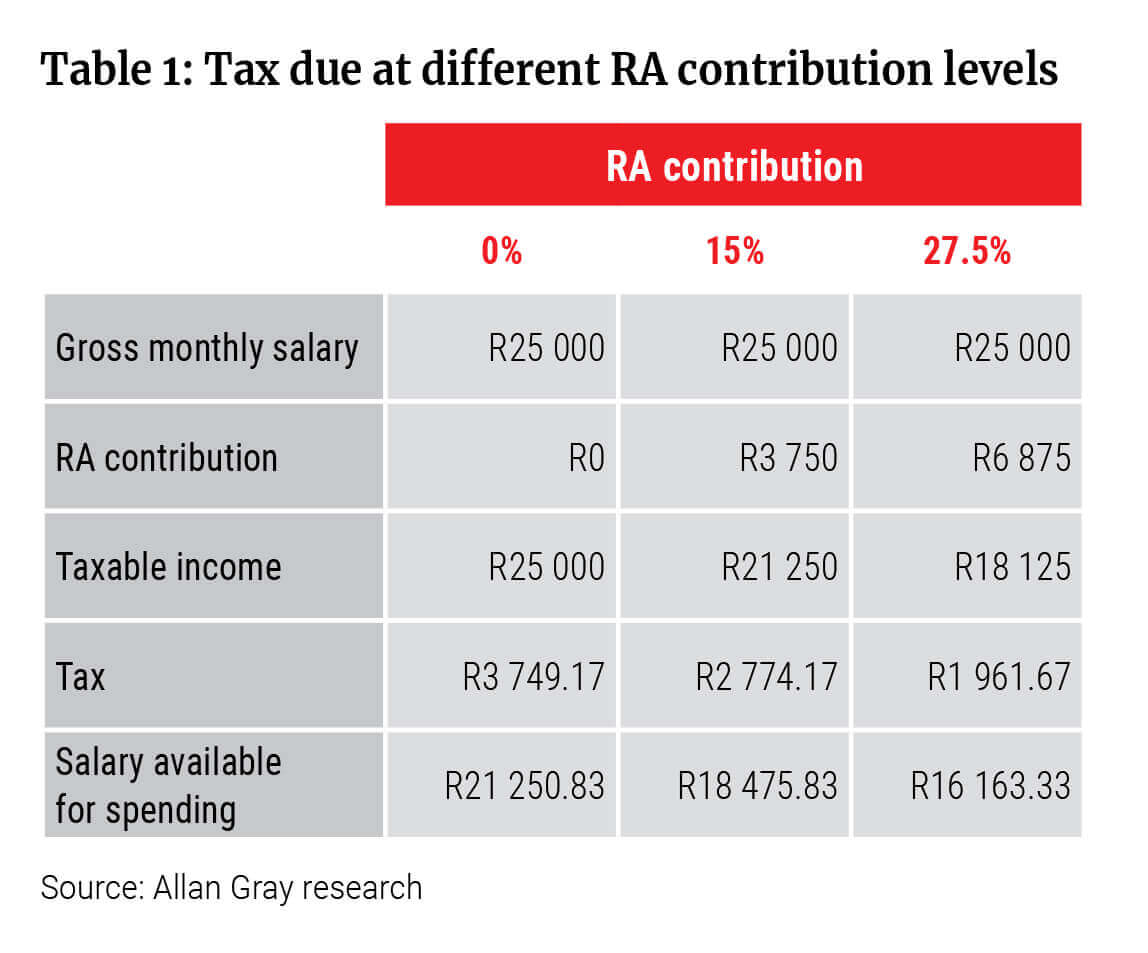

how does retirement annuity reduce tax Camellia Mcclintock, Granting income tax relief by adjusting brackets and rebates for the effect of inflation. And this window runs till 21 october 2025.

Notes On South African Tax 2025 Image to u, The table below shows the personal income tax rates for 2025/25, as well as the rebates and thresholds. In addition to no adjustments for the tax brackets, the.

Tax rates for the 2025 year of assessment Just One Lap, 2025, 2025, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, etc. Granting income tax relief by adjusting brackets and rebates for the effect of inflation.

Individual Tax Rates 2025 South Africa. Rates of tax for individuals. 2025, 2025, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, etc.

Individual Tax Brackets 2025 South Africa Britte Maurizia, Granting income tax relief by adjusting brackets and rebates for the effect of inflation. Rates of tax for individuals.

Tax Rate 2025 Individual Kayla Melania, You are viewing the income tax rates,. Use our online income tax calculator designed for individuals to help you work out your estimated monthly take.

The overall maximum effective tax rates for individuals remain unchanged from last year at 18% and for companies and trusts it is 21,6% (previously 22,4%) and.

Individual Tax Rates 2025 Calculator Fayre Jenilee, Definition of resident individuals any person who is ordinarily resident in south africa. Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year.

4. The tax system in South Africa Assessing Tax Compliance and, Calculate your personal income tax for 2025/2025. 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa.

South African Company Tax Rate 2025 Image to u, Granting income tax relief by adjusting brackets and rebates for the effect of inflation. Any person who was physically present in south africa for greater than 91 days per tax year.

Information is recorded from current tax year to oldest, e.g.